For better or worse, richer or poorer...

Dear readers, a warning: I'm ready for an all out get-on-your-soap-box and scream-at-the-top-of-my-lungs rant based on the word "disintermediation" submitted by Bill L.

I am sick and tired of listening to politicians, mainstream media, liberals, conservatives, and everyone else who complains about the warfare between Main Street and Wall Street. In the immortal words of Peter Griffin, this grinds my gears. Politicians, who continue to take money from investment banks, decry how evil and corrupt Wall Street (read New York Jews and wives of certain cheating governors from the South) bankers took advantage of poor illiterate folk in middle America for their own mega million dollar bonuses. Other politicians, who continue to take money from investment banks, decry the irresponsibility of the average American and demand investors take losses and people lose their homes if they can't afford them.

Michael Moore and Oliver Stone are all over this topic with their agendas hanging out for all to see.

I can see it now! John Carpenter's new horror film "They came from Lower Manhattan!" or a remake of the 1951 classic "The day the banking system stood still".

Wall Street and Main Street are not North and South Koreans. They are a bickering husband and wife team; with the common goal of cheap financing for their kids (read consumers) through financial disintermediation. Without Wall Street providing cheap financing, Main Street couldn't sell cars, televisions, cameras and other goodies. Remember 0% rate credit cards? Thank Wall Street. Remember low auto loans? Thank Wall Street. Enjoy low rate mortgages with 0% down? Thank Wall Street. Enjoying the credit crisis? Thank Wall Street.

Main Street was no better. Main street was enjoying her wine and lawn parties. The kids were entertained with shiny new toys and tree houses. Even the Valium tasted better. However, Wall Street and Main Street forgot fiscal discipline (with or without a belt) and the lessons of the Great Depression.

Both Main Street and Wall Street, hurting after the great depression, slowly sold the consumer society to Americans decade after decade in the same way crack was free in the park near where I went to High School. Americans like their new Buicks and GTOs. Americans were able to send their kids to college and buy televisions. The marketing was everywhere.

In the early 2000s, financial technology allowed money from all over the world to invest in the American dream. This money allowed "Kid" consumers to use their homes and improving credit scores as a free ATM so they could spend money on Main Street. Investors helped finance all sorts of things: cheap car loans, cheap credit cards, cheap municipal financing, cheap computers, cheap capital investments, cheap mortgages, cheap refrigerators, and cheap visits to foreign countries. Wall Street was our hero! We had achieved the greatest financial disintermediation in history. Congress and the Federal Reserve board got into the act by getting rid of protections and keeping rates low respectively.

Main Street and consumers thrived and used this cheap credit like the fiscal crack addicts they are. They needed it and justified using it by what a swell timing they're having. Wall Street, ever the drug supplier, needed Main Street to keep the lending going. Everything was great until the music stopped and the government sponsored methadone treatment began. I'm sure there is a 12-step program to help.

Like a Lifetime channel movie, the hero (is there one?) has hit bottom, is in rehab and will live happily ever after ... until the next slip.

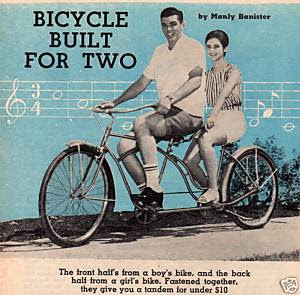

The Credit Cycle built for two couldn't handle the speed it was going down hill and ran into some not so innocent bystanders like Iceland, AIG, and many others. It will take more than Mom's kiss to make this boo-boo go away.

See you all next week.

Subscribe to:

Post Comments (Atom)

THE WORLD IS ON FIRE AND NOBODY HAS NOTICED. ROCK ON

ReplyDelete